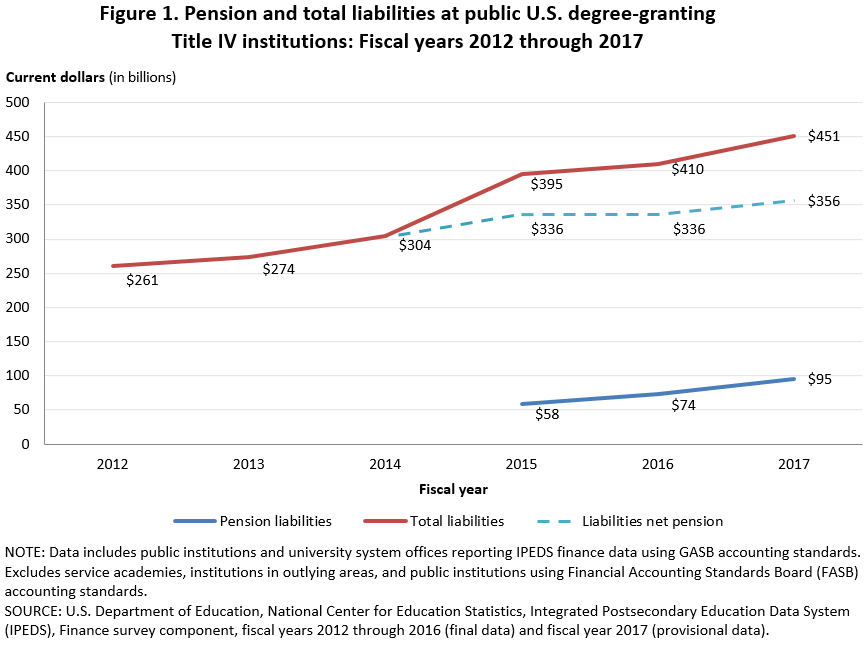

In the long-standing conversation of high college costs, ever wonder what public colleges and universities owe? For Fiscal Year (FY) 2017, the National Center for Education Statistics (NCES) using the Integrated Postsecondary Education System (IPEDS) found that 1,624[1] public institutions carried debt and total financial obligations of $451 billion in current dollars (see figure 1).

New finance data from IPEDS can now provide more insight about these obligations than was previously available.

Several common financial obligations or liabilities[2] can be found across all U.S. postsecondary institutions. A portion of an institution’s liabilities can be attributed to pension benefits and contributions (i.e., pension liabilities). Since fiscal year 2015, IPEDS collected data on these obligations as a specific part of the total debt held by public postsecondary institutions. For example, the total amount of pension benefits and contributions that public institutions owed their employees in FY 2017 was $95 billion (see figure 1).

Before FY 2015, institutions did not have to report to NCES their pension liabilities and the total liabilities for public institutions were $304 billion in FY 2014. However, after the change in reporting standards, the total liabilities for all public institutions jumped to $395 billion in FY 2015. This increase is greater than increases in all other fiscal years from 2012 to 2017. This finding suggests that the implementation of the new pension reporting standards may have contributed to the change in the increasing trend of total liabilities data.

Reporting Change in Context

Prior to the revised pension reporting standards, dating back to 1997, public institutions reported the difference between their annual required contribution to the pension plan(s) and the actual annual contribution (e.g., net pension obligation). The revised standards—known as Government Accounting Standards Board (GASB) Statements 67 and 68—require institutions to report the entire unfunded pension amount (e.g., net pension liability), not just the amount of deficiency in annual payments.

Including the full current pension liability of the institution instead of the annual shortfall in pension funding of the institution resulted in large shifts in the balance sheet of many public institutions. For example, if an institution had a total of $2 million in pension liabilities, prior to 2015 this institution would not report the $2 million in net pension liabilities, just the amount below the required contribution for that year that was actually paid. Now, this institution must report the full $2 million in net pension liabilities, even if the annual required contribution had been paid in full. This revision of the financial reporting standards resulted in increased transparency and accuracy of the total amount of liabilities reported by institutions.

Additional IPEDS Resources

NCES encourages educational researchers to use IPEDS data—a primary source on U.S. colleges, universities, and technical and vocational institutions. For more information about the IPEDS data, visit the IPEDS Survey Components page.

While finance data from the IPEDS collection may seem to be targeted for accountants and business officers, researchers interested in a postsecondary institution’s financial health can explore through expense and revenue metrics, resulting in possible data-driven, bellwether information. To learn more about an institution’s finance data, in particular its pension benefits, click here for the current finance survey materials; archived changes to the survey materials in 2015–16 (FY 2015)—such as the implementation of the new pension reporting standards; and links to Video Tutorials, FAQs, glossary definitions and other helpful resources.

By Bao Le, Aida Ali Akreyi, and Gigi Jones

[1] This total includes 735 four-year public institutions, 889 two-year public institutions, and 63 administrative public system offices (41 four-year and 22 two-year offices). Administrative system offices can report on behalf of their campuses. The four non-Title IV-eligible U.S. service academics are not included.

[2] Liabilities include long-term debts (current and noncurrent) as well as other current and noncurrent liabilities such as pensions, compensated absences, claims and judgments, etc.